If you are planning to buy a property in Costa Rica, one thing you should do is make sure that the property is lien-free. Ideally, the seller will let you know if the property has any, however it is best if you verify the information on your own.

Step by step

It is important that you take the following steps that will let you know if property you want to buy has any type of lien.

A lien is an affection, charge or tax, either commercial or civil. Is an obligation that is made on an asset to respond to a specific debt of the owner. The most common in real estate are the already known mortgages. but how do you know if the property has any affectation of this type?

The first thing you have to know is that you can consult it through the website of the National Registry. That page looks like this:

You must become a user with is done only with an email and the password that you want to use. After that, click on the blue window that says “sistema de certificaciones y consultas gratuitas”. After this, it gives you the option to “registrarse por primera vez” with is a large button that appears in the upper left.

When you already have the user:

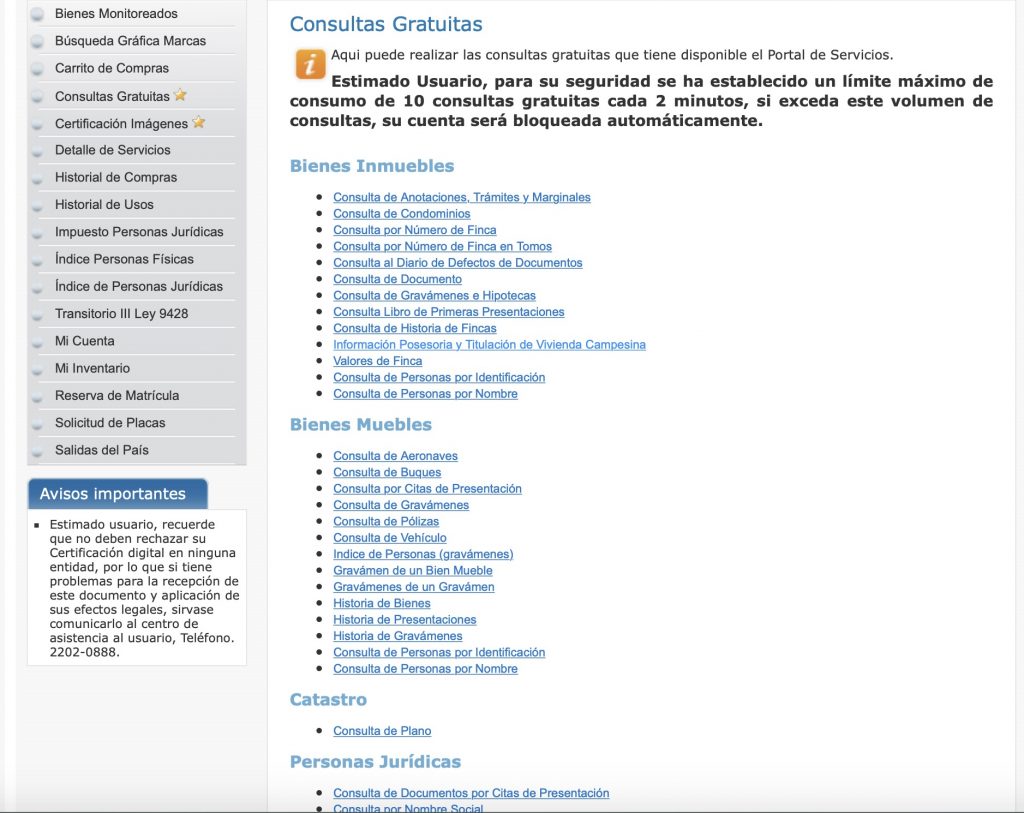

Once the above is completed and your user is registered, a page appears with a gray column on the left. Click on the option that says “consultas gratuitas”. The page should look something like this:

When you are on this page, you can consult each of the options in the column. It is important that you need to know in advance what is the property number. However if you do not know what it is, you can consult it through the ID number or the full name of the owner. The page is really simple, you can follow the sep by step and not get lost.

Make sure that the property you want to buy is lien-free can save you a lot of time and money if you find yourself in front of a seller who is not totally honest and who wants to involve you in uncomfortable situations. Although it is not most of the time, it may happen that if you dont, you end up paying a mortgage that is not yours or with your house foreclosed in the worst case. Remember that you can buy a mortgaged house. But if you do, it is essential that you are aware of it and decide with your lawyer how to proceed.

Also the website doesn’t have any English option. So the best you can do if you don’t understand Spanish is to call the call center number that appears in the home page of the site and they would help you to find the answers.