Commission for Real Estate Advisory

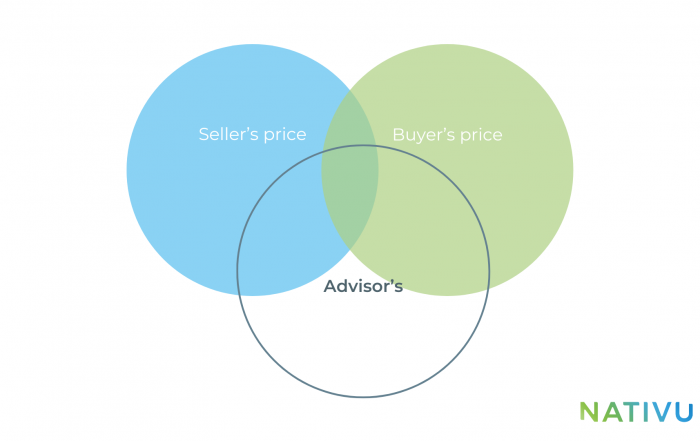

The value of a real estate consultant is very important, as he can determine the course of the sale of your property. An advisor knows the state and type of the market, how to navigate it, how to handle a potential client, what to do to sell your home, etc. This advice is invaluable, and facilitates the entire transaction process for you as the owner. The commission will be determined by said advisor and his company, in addition to the fact that VAT must be covered. This cost is non-negotiable, especially the legal cost.

Tax on Capital Gain

This cost is non-negotiable and it falls directly to the owner; This will not be paid only if the property sold was the primary residence and not an additional productive lot or farm. If the real estate sold was land on which the owner did not live, then he must pay this tax. This cost can be 2.5% of what is left on the books of the transaction or 15% of the profit.

Other Costs

Generally these costs are not financial or legal, but maintenance and other contingencies. For example, the cost of maintaining a house (keeping it presentable), the costs of canceling basic services, or moving costs.