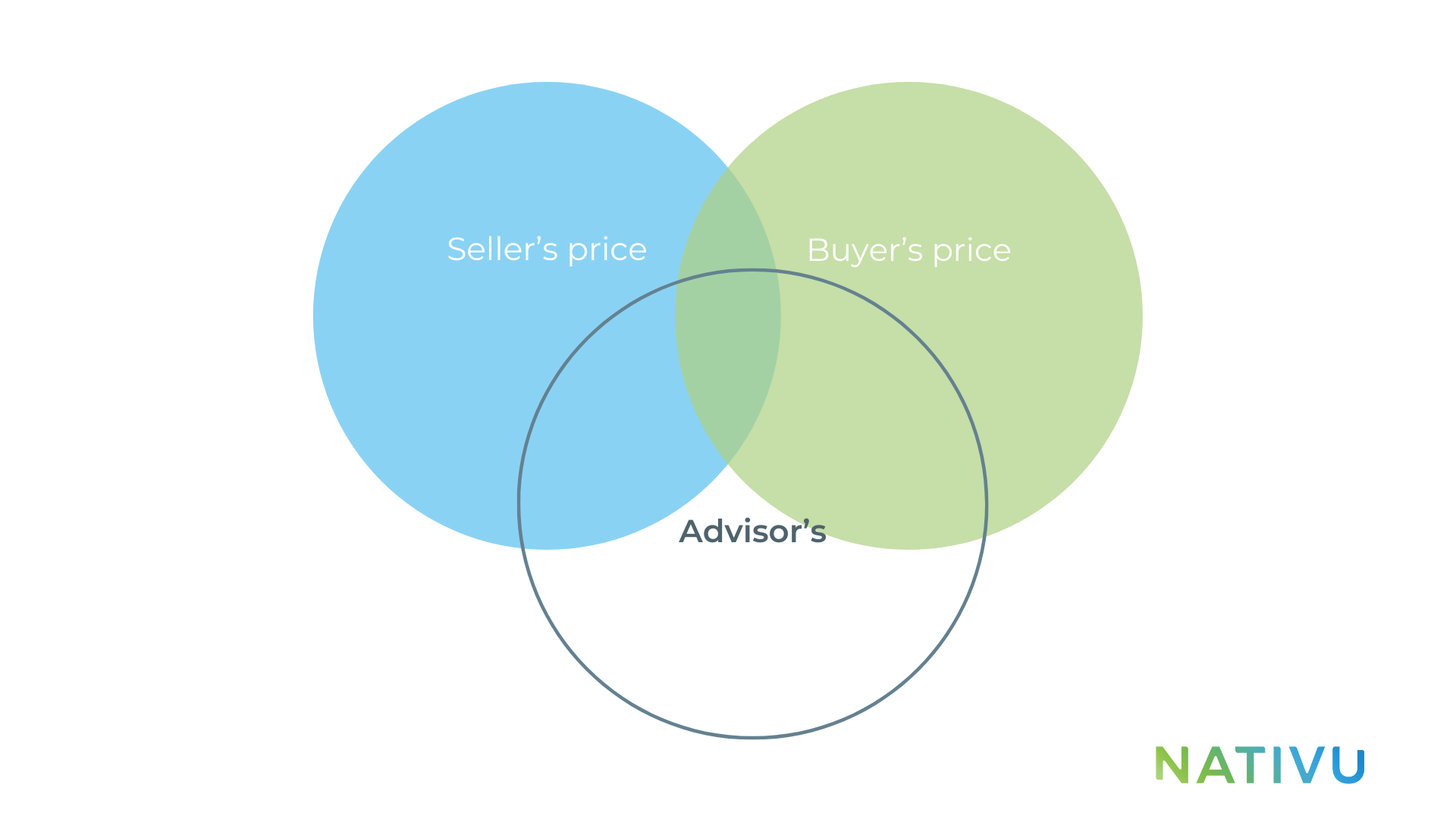

The price of a listing is the documented amount with the correct context for a possible transaction. This price varies according to the sale expectation and whether or not it includes generating activities or extra obligations. To determine it, different tools must be used based on the three prices that exist;

- The owner’s price

- The seller’s price

- The advisor’s price

The first two have different variables, since the owner and the seller have their own interests that directly influence the price at which they value the listing. There are different factors to take into account when analyzing both elements, that is why the price given by the advisor must be neutral, pondering the values given by the parties, but in a fair way and according to the market.

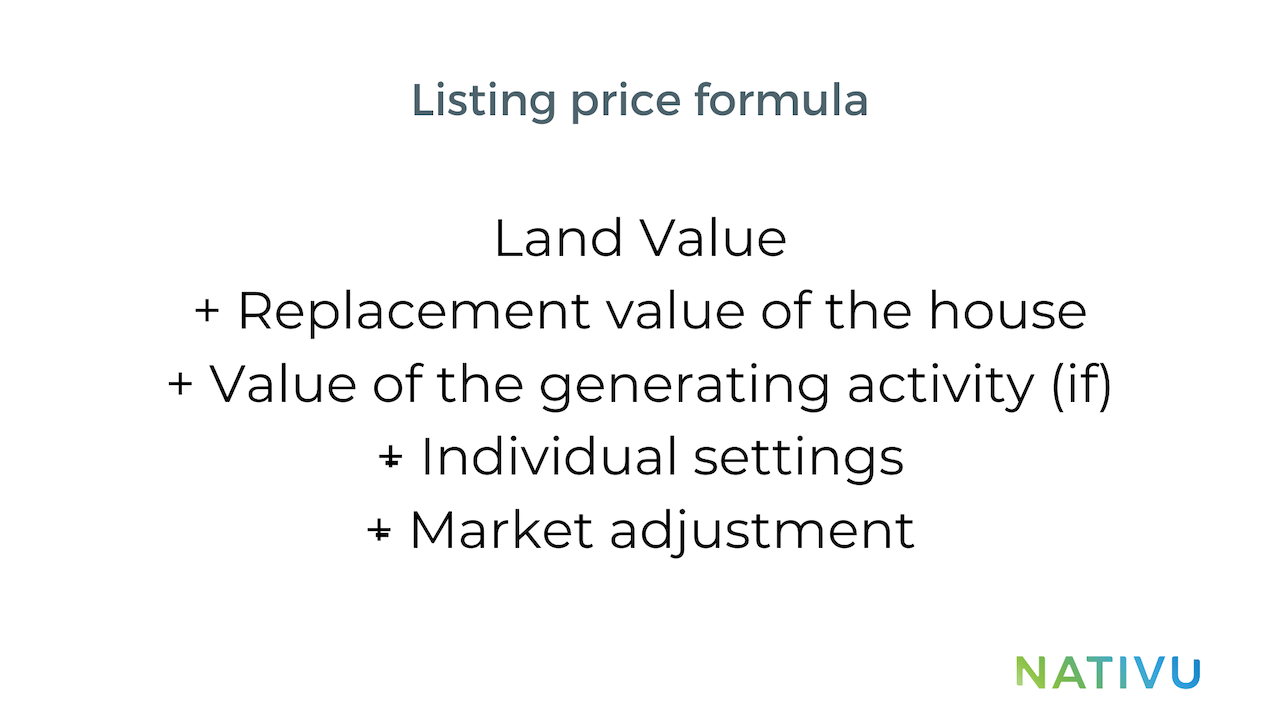

This is what you should be considering when analyzing each of the real prices of sale:

All the values in the formula can be determined through studies of prices, availability, municipal taxes, values of m2 by zone, sales histories, location, inventories of finishes and any other comparable option. Including professional appraisals which is a technical instrument that can determine real values in the price of the property, however it is important to keep prices in ranges, because the estimates are not absolute.

All the information obtained through conversations with clients must be taken into account when giving the advisory price. It is recommended to maintain feedback between all parties, since in the end you can learn a lot about the market through meetings with the different participants.

Clear and transparent communication regarding prices can avoid problems in the final stages of the negotiation. Giving a fair price, adjusted to the reality of the market is essential to reach a balance between the different prices of the property and finally conclude the transaction in the most effective way.