As a property owner it is very important that you are up to date with all your payments and legal duties towards the Ministry of Finance and your local government, part of it is the income tax. This is the law No. 7092, which stipulates that a certain percentage is taxed on the utility of individuals, companies, or other legal entities.

Income tax is an important part of the country’s tax system because its objective is to finance various projects and services that the government provides to citizens and has important implications for the market.

The Current Outlook

Currently, if you have land or buildings to your name, the sum to be paid to the municipality is 0.25% of the property value, that is, for every million of the total property value you pay ¢ 2500.

To give a clear example, suppose that your property is worth 50 million colones, 0.25% would be equivalent to ¢ 125000 that must be destined for income tax.

What will be the change?

For the income tax in Costa Rica, the proposal that the government seeks to present to the International Monetary Fund is to triple the income tax on lots and houses, going from 0.25% to 0.75%. This increase, taking the previous example, would mean that for a property of 50 million colones, a tax of ¢375,000 would be paid instead of the current ¢125,000.

In other words, the increase represents ¢7,500 for every million of the value of the property in question. However, there are other factors that come into play when calculating the tax payment.

For example, if you have a single property whose value exceeds ¢20.3 million, you have to your advantage the exemption benefit over the first ¢20.3 million.

This is good news, since you should only cancel the balance for the amount that is exceeded, in the case that we have worked, you would have to pay for the remaining 29.7 million of the property’s value, which would be approximately ¢75,000.

On the other hand, in addition to the number of properties you own, the amount to be paid is influenced by different variables, including:

- Building conditions (roof, walls, floor)

- The facilities and services you have

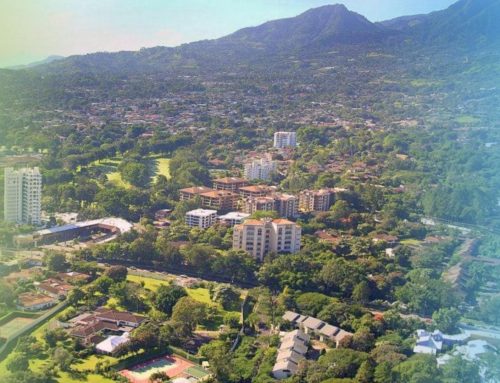

- The location of the lot or building

- The shape of the terrain

- How new is the building

Remember to check well how much you have to pay for these taxes, it is best to hire the services of an accountant or a professional in the matter to have all your papers and duties up to date, and thus avoid fines.