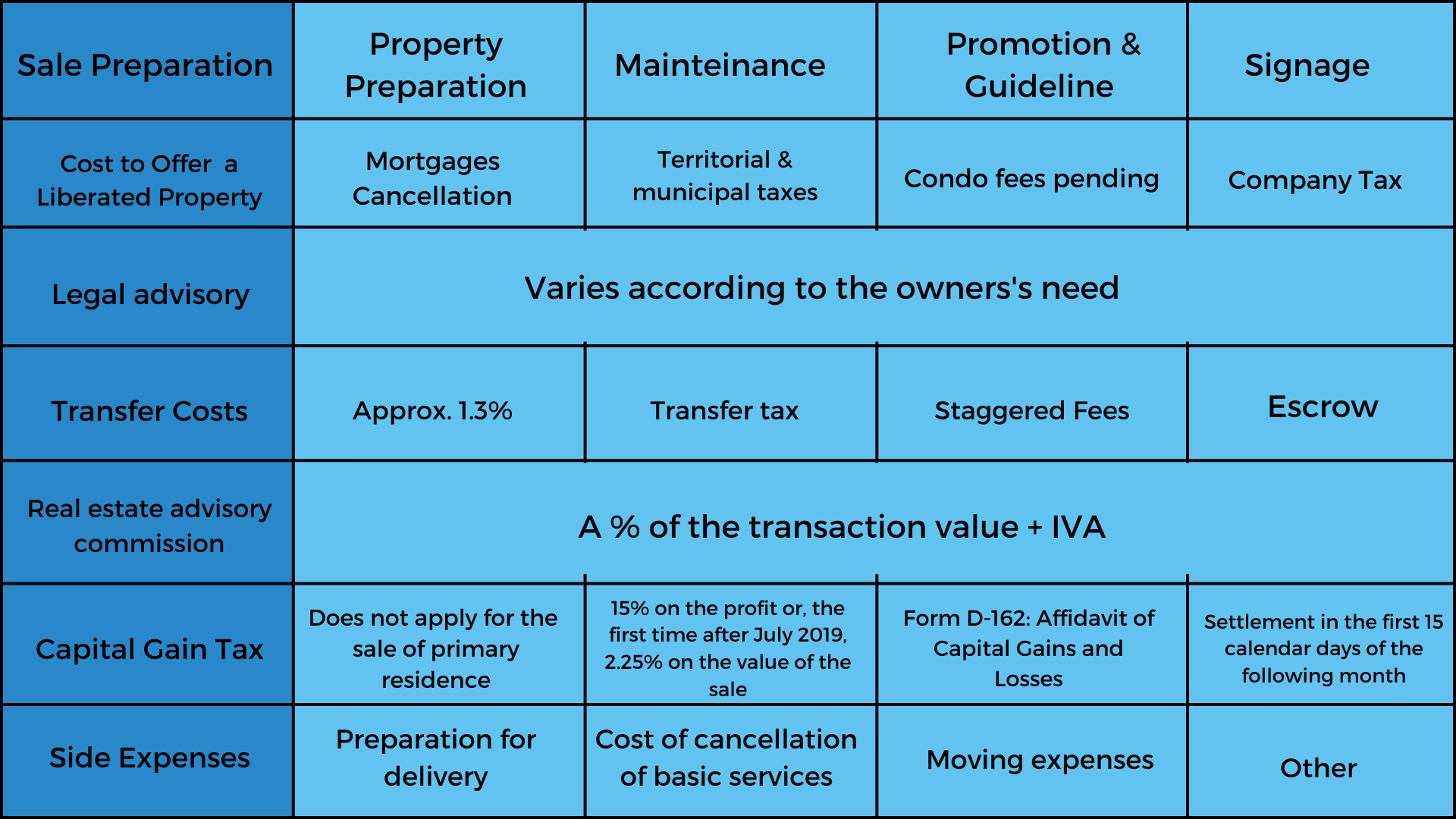

When making a great decision we always have to take into consideration many important factors; among them one of the first is always the cost of making this new decision. If you are thinking of, or have already decided, to sell your property; we want to inform you about all the transaction costs that this new process will include for you as a seller. At NATIVU we are well informed about every aspect for the sale of a real estate property before, during and after the entire process, we’ll explain next:

Transaction Costs for the Seller

For us it is very important that our clients are informed of all the costs associated with the sale of the property that they are going to make. This is why our advisors are qualified to answer all the questions that may arise regarding this and any other part of the sales process. In addition to that they will always inform you about these costs in a transparent way at each stage of the transaction. You just have to focus on investing wisely, and living happily!